The Basic Principles Of What Does Renters Insurance Cover, Not Cover, How Does It ...

Clarify what you need, when you require it, as well as why you are entitled to it (cheapest). Keep a case journal and document that you chatted to, when you called (date/time), what was said.

The California Fair Claims Settlement Practices Act lays out the claim handling standards your insurance firm ought to be adhering to. It consists of 15 days to reply to communications (by e-mail, letter, or telephone call), 40 days to pay or reject your case, as well as if they are incapable to choose, they have to send out a letter mentioning what they require from you to make a decision, the length of time they need to make the choice.

If you normally pay $1,500 in lease per month, however currently are paying $2,000 for your short-lived rental while waiting for your previous home to be fixed, the added $500 is an enhanced cost. If your month-to-month food costs were $500 and now you have to dine in a restaurant as well as your expenses are currently $1,000, then the extra $500 is an increased price.

While California state legislations need insurers to offer ALE for a duration of at the very least 36 months, most tenants' plans have minimal limitations as well as the insurer is not obliged to pay above the restriction specified on your "dec" web page. The following step is to take stock of your personal effects losses.

Ask for a breakthrough of your "Protection C" to get begun. If you have actually experienced a complete loss and also your restrictions are low, ask (in composing) for a waiver of the inventory demand and also a "cash money out"/ negotiation of your contents/personal residential or commercial property limitations.

Landlord And Renters Insurance Fundamentals Explained

Devaluation is the reduction in worth of your personal residential property because of deterioration to account for its It is essential to comprehend 3 points concerning devaluation: 1) There's no person established formula, devaluation is subjective as well as negotiable. 2) Some things do not decline as a result of age and need to not be decreased.

In California, the majority of tenants plans provide substitute expense coverage, but not all. Be certain to look for a on your affirmations page as well as plan.

Finally, bear in mind that healing is a marathon, not a sprint, and United Policyholders is right here to help. www. uphelp.org The information offered in this publication is for general informative objectives, as well as must not be taken as legal suggestions. If you have a details lawful issue or issue, United Policyholders ("UP") suggests that you consult with an attorney.

If you stay in a rented out home, house or condominium, your proprietor's insurance coverage does not cover your personal property, such as your electronic devices, bike, jewelry, or furniture, in the event that it is harmed, damaged, or taken. If you live with roomies, research the opportunity of purchasing a tenants insurance coverage together. options.

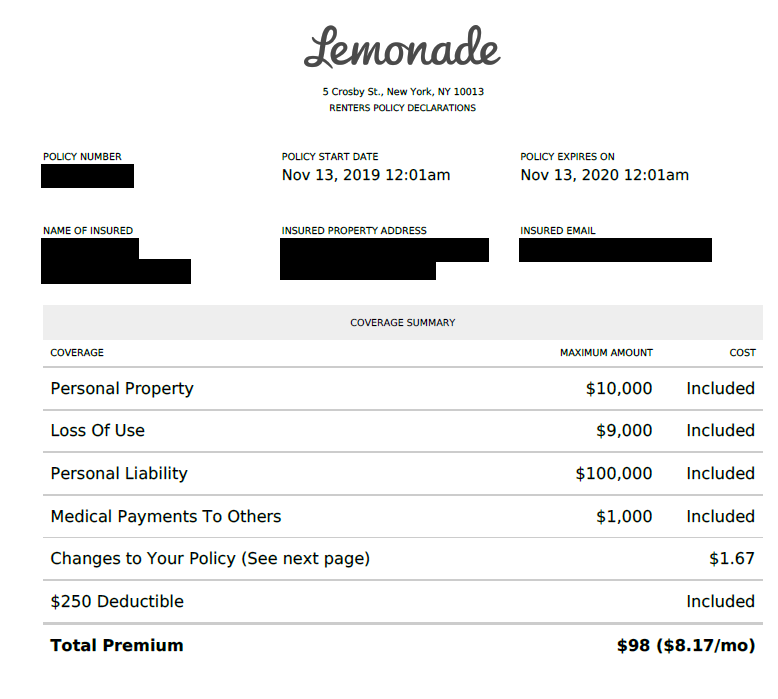

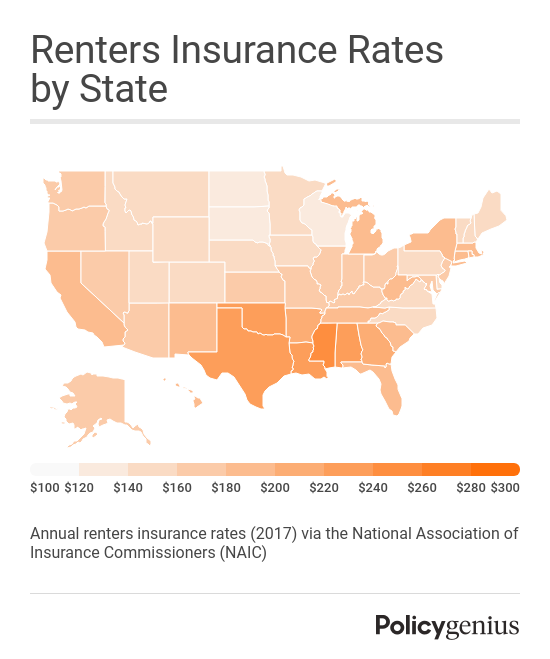

If you are a trainee and also are a based on your parent's insurance coverage, your parents must consult their homeowner's insurance coverage firm to establish whether your personal belongings will be covered under their plan. The premiums for renters insurance policy standard between $15 as well as $30 each month depending on the place as well as dimension of the rental unit and the insurance holder's ownerships.

The Best Strategy To Use For Renters Insurance 101 - Progressive

This is the amount of insurance you will require to change the materials of your residence if whatever were damaged - rental. The majority of occupants insurance policies supply 2 fundamental types of insurance coverage: personal building as well as responsibility.

cheapest lease renter insure options

cheapest lease renter insure options

This is the most generally bought tenants policy. Obligation insurance policy gives insurance coverage versus a case or lawsuit arising from bodily injury or residential or commercial property damages to others caused by a mishap while on the insurance policy holder's property. Uncommonly pricey items, such as fine jewelry or an art collection, might need the tenant to buy additional protection, called a "motorcyclist" or "drifter".

damages renter low cost rental low cost

damages renter low cost rental low cost

An additional important factor to look for when looking for renters insurance policy is "real money value" vs. "replacement cost" insurance coverage. Real cash-value protection will reimburse you for the expense of your personal effects at the time of the case, minus the deductible. It's essential to account for depreciation when considering this coverage option.

Substitute expense protection, on the other hand, will compensate the amount of the brand-new stereo system, after you buy the new system and send your receipts (damages). While the up-front price is better, you are more probable to receive exact settlement for your belongings.

Tenants have a special collection of insurance coverage requirements. Insurance can cover their clinical costs and any kind of resulting lawful activity - price.

5 Things You Probably Don't Know About Renters Insurance - An Overview

Take a moment to review a few of the coverages1 we provide prior to getting an online tenants insurance quote or talking to your Mercury Insurance representative about a tenants plan. You'll rejoice you did.

cheapest renters insurance insure affordable property management cheaper

cheapest renters insurance insure affordable property management cheaper

Regardless, you would certainly still have to pay $3,500 expense. Considering you underinsured your fashion jewelry by $1,500 and your computer by $500, the insurance policy firm would bear in mind of that and also it would be consisted of in the $3,500 that's not covered. home insurance.

All of your prized possessions can be safeguarded by affordable ERIE. Discover out why it makes feeling to do business with ERIE.

If you are a renter, after that you may be examining if it's really needed to purchase your own insurance coverage plan (low cost). Certain, you would certainly have to get insurance coverage if you were the homeowner yet do you really require it as a renter?

Without occupants insurance policy, you will certainly need to pay of pocket to replace your television. With renters insurance policy, your insurance service provider can cover the expenses of a brand-new television. Tenants insurance can likewise cover injuries to site visitors at your residence. If someone experiences an injury on your building, after that they can file a claim with your insurance provider to recover payment for losses such as medical expenditures and lost wages.

Some Known Incorrect Statements About How Does Renters' Insurance Work? - Blog - Express Financial ...

Listed below you will certainly find a few of the most common types of coverage that tenants insurance policy can supply. Liability Coverage Liability protection is just one of one of the most important components of occupants insurance coverage as well as an important part of a conventional plan (cheap). Obligation protection enters into play in several circumstances but one of the most usual kind of responsibility case occurs when somebody experiences an injury in your house.

If you leave your house for a weekend and also return to locate that someone damaged in and swiped your possessions, then you could replace your things with the insurance coverage offered by your renters insurance policy. Without renters insurance policy, you 'd be expected to pay for every one of your shed residential property out of your very own pocket.

lease option affordable insurance cheapest renter

lease option affordable insurance cheapest renter

You will certainly likewise need to before you can get payment. Nonetheless, when you pick set up personal residential or commercial property insurance coverage, you do not have to think about depreciation. You get coverage for the complete worth of the item you shed arranged personal effects plans usually include electronic devices, fashion jewelry, weapons, organization residential or commercial property, and various other high-value items.

When you have reimbursed living expenditure coverage in your insurance coverage, you can receive payment for these expenditures. water damage. If you can not live in your residence for a time period as a result of harm for which you submitted a renters insurance policy claim, the insurance policy business will compensate you for your price of living.

Visitor Medical Coverage Guest clinical protection is one more essential component of your renters insurance coverage - insurance. In case somebody suffers an injury on your residential property, they might require to look for clinical attention right away and also they might

Welkom bij

Beter HBO

© 2026 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO