The 10-Second Trick For How Long Do You Need Sr22 Insurance In Colorado?

Normally, an insurance provider will certainly not make a modifications on a person's auto insurance plan up until as well as if they are founded guilty of an OWI infraction or their vehicle driver's certificate is put on hold. no-fault insurance.

It is essential to bear in mind that your need to keep the SR-22 insurance policy for the defined amount of time or your permit is suspended once more. If your policy terminates or expires for any type of factor the insurance policy company is legally obligated to submit a SR-26, which notifies the state of the plan termination.

When your present carrier does not issue SR22 forms it's time to do some research. When looking to buy an SR22 there are a couple of points to think about: 1) See to it the insurer is accredited to do company in the state of MO. 2) Like with every little thing else, experience issues.

3) Expert and pleasant service. After everything you've been via you desire the last action of obtaining your license back to go smoothly as well as with out judgement. Why do I require an SR22 if I don't possess a vehicle? Every state that needs an SR-22 filing, calls for that you have the state mandated obligation coverage whether you are a car owner or a non-owner (do not very own vehicle).

By needing you to have SR22 insurance coverage with or without a cars and truck, the state feels they are shielding the various other chauffeurs when driving. Where can I obtain an SR22? As pointed out over, not all insurance provider sell SR22s., powered by Wessell Insurance Solutions, llc, has been supplying cars and truck insurance coverage since 2006.

Facts About Sr22 California - What Is It? When Do I Need It? How To Get It? Uncovered

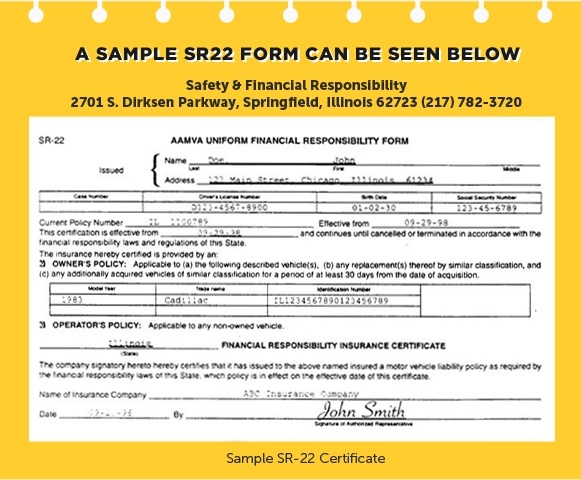

What is an SR-22? An SR-22 is a certificate of economic responsibility required for some chauffeurs by their state or court order. An SR-22 is not a real "type" of insurance policy, yet a kind filed with your state. This form works as proof your auto insurance coverage satisfies the Go to this website minimum responsibility protection called for by state law.

ignition interlock vehicle insurance ignition interlock motor vehicle safety insurance coverage

ignition interlock vehicle insurance ignition interlock motor vehicle safety insurance coverage

Rules vary from state to state.: DUI sentences Negligent driving Accidents triggered by without insurance chauffeurs If you need an SR-22/ FR-44, the courts or your state Motor Car Department will notify you.

Present Consumers can call our Consumer Solution Department at ( 877) 206-0215. We will certainly examine the protections on your policy and also start the process of filing the certificate on your behalf. Exists a charge connected with an SR-22/ FR-44? Many states charge a level cost, yet others need an additional charge. This is a single fee you should pay when we file the SR-22/ FR-44.

A declaring charge is charged for each private SR-22/ FR-44 we file. As an example, if your spouse gets on your policy and also both of you need an SR-22/ FR-44, after that the filing cost will be billed two times. Please note: The cost is not consisted of in the price quote because the filing fee can differ.

Your SR-22/ FR-44 needs to be legitimate as long as your insurance policy is active. If your insurance coverage policy is terminated while you're still required to carry an SR-22/ FR-44, we are required to notify the proper state authorities (dui).

The smart Trick of What Is Sr22 Insurance & How Much Does It Cost? That Nobody is Discussing

The SR-22 demand starts on the day of the sentence. You are the proprietor of a car that was without insurance at the time of a mishap. The SR-22 need starts on the day of the crash. You are attempting to renew your driving opportunities. The SR-22 requirement starts on the end date of the suspension.

The SR-22 need begins when you apply for the license as well as ends when the permit expires. Out of State Declaring, Even if you live out of state, you have to submit an SR 22 with Oregon (if required) prior to another state can provide you a driver certificate.

dui sr-22 insurance bureau of motor vehicles vehicle insurance sr-22

dui sr-22 insurance bureau of motor vehicles vehicle insurance sr-22

How Much Time Does SR-22 Last? This is a common concern that elevates a great deal of worries amongst high-risk chauffeurs, but it's important to note that it will not last for life. sr22. So, the length of time do you need to have an SR-22? It depends upon your state, many require that you maintain it for three years, yet it can differ from one to five.

If you currently have active insurance coverage, you may have the ability to call your current insurance firm and also ask to include an SR-22, which it will send out to the AZ MVD. ignition interlock. Nevertheless, you may need to obtain a brand-new insurance plan, as numerous insurance provider will cancel your coverage after discovering your new SR-22 demand.

ignition interlock sr-22 insurance sr22 insurance division of motor vehicles liability insurance

ignition interlock sr-22 insurance sr22 insurance division of motor vehicles liability insurance

It's a good concept to talk to several to locate a more affordable price. When collecting quotes, be honest concerning your situation as well as answer inquiries connecting to your sentence. Some insurance providers clearly ask whether you require an SR-22, while others only ask about the circumstances that would bring about requiring one (ignition interlock).

Fascination About How Long Does An Sr-22 Last? - Insurance Panda

As soon as you've reached the three-year limit, double-check with the AZ MVD that you are no more needed to bring the policy. After that call your insurance provider to terminate the SR-22. You should have the SR-22 on apply for 3 continual years not just the three-year period after your license was revoked.

USAA's rates increased by 166% for a vehicle driver who needs an SR-22. Our listing of insurance providers below compares the typical annual prices for a 30-year-old guy with and without an SR-22 declaring and also DUI sentence (sr-22 insurance). You must always contrast several quotes in between insurer to guarantee you are picking the best alternative.

The file validates you have actually purchased insurance coverage; your insurance company is likewise called for to notify the Arizona MVD if your insurance plan is canceled. If you have actually an SR-22 submitted with the state, you're commonly called having "SR-22 insurance coverage," although it's not practically a various sort of insurance coverage.

These offenses both normally result in a permit suspension or revocation, as well as you'll require to get an SR-22 in order to have your permit reinstated. deductibles. Nonetheless, a court may make a decision to call for that you obtain an SR-22 in various other scenarios too, such as if you have way too many factors on your certificate or have also several overdue tickets.

In this instance, you'll need to acquire SR-22 insurance. auto insurance. Nonowner protection is generally less costly than regular cars and truck insurance coverage since it does not include protection for a vehicle. It's additionally more affordable because it assumes you will not drive as frequently as somebody who has a lorry as well as drives it consistently.

Some Known Facts About Sr22 Insurance In Olympia & Centralia, Wa.

If you already have active protection, you may be able to call your existing insurance provider and also ask to add an SR-22, which it will certainly send out to the AZ MVD. However, you might require to get a new insurance plan, as numerous insurance coverage companies will terminate your insurance coverage after finding out about your brand-new SR-22 need.

It's a great concept to get in touch with numerous to locate a cheaper rate. When collecting quotes, be sincere about your circumstance and answer questions connecting to your conviction. liability insurance. Some insurance firms clearly ask whether you need an SR-22, while others just ask concerning the conditions that would bring about requiring one.

Once you have actually gotten to the three-year threshold, double-check with the AZ MVD that you are no more called for to lug the plan. Call your insurance coverage business to terminate the SR-22. You must have the SR-22 on apply for 3 continual years not just the three-year duration after your certificate was revoked. division of motor vehicles.

department of motor vehicles dui sr-22 credit score insure

department of motor vehicles dui sr-22 credit score insure

USAA's rates boosted by 166% for a chauffeur that needs an SR-22. Our checklist of insurance firms below compares the average annual rates for a 30-year-old man with as well as without an SR-22 declaring and DUI sentence. You ought to constantly compare several quotes between insurer to ensure you are selecting the finest alternative.

The document confirms you have actually acquired insurance policy coverage; your insurance company is likewise required to alert the Arizona MVD if your

Welkom bij

Beter HBO

© 2026 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO