The 10-Minute Rule for How Much Does Car Insurance Cost? - Lemonade

Travelers provides safe driver discount rates of between 10% and 23%, depending on your driving record. For those uninformed, points are usually assessed to a motorist for moving violations, and more points can result in higher insurance premiums (all else being equal). 3. Take a Defensive Driving Course Sometimes insurer will supply a discount for those who complete an approved protective driving course - low cost auto.

Ensure to ask your agent/insurance business about this discount before you register for a class. After all, it is very important that the effort being used up and the expense of the course equate into a huge enough insurance cost savings. vehicle. It's likewise important that the chauffeur sign up for an accredited course.

4. Search for Better Vehicle Insurance Rates If your policy is about to renew and the yearly premium has actually gone up noticeably, consider searching and getting quotes from competing companies. Likewise, every year or 2 it probably makes sense to obtain quotes from other business, simply in case there is a lower rate out there.

That's since the insurance company's credit reliability need to also be considered. After all, what good is a policy if the company doesn't have the wherewithal to pay an insurance coverage claim? To run a check on a particular insurance provider, consider having a look at a site that ranks the monetary strength of insurer. The financial strength of your insurer is essential, but what your agreement covers is likewise crucial, so make sure you understand it.

In basic, the fewer miles you drive your cars and truck per year, the lower your insurance coverage rate is most likely to be, so always inquire about a company's mileage limits. perks. 5. Use Mass Transit When you sign up for insurance, the company will normally begin with a questionnaire. Among the questions it asks might be the variety of miles you drive the insured vehicle each year.

Discover out the specific rates to insure the different vehicles you're considering before making a purchase., which is the amount of cash you would have to pay before insurance picks up the tab in the occasion of an accident, theft, or other types of damage to the vehicle.

Enhance Your Credit Score A chauffeur's record is certainly a big aspect in identifying auto insurance costs. It makes sense that a chauffeur who has actually been in a lot of accidents might cost the insurance coverage business a lot of money.

The Facts About Car Insurance Rates By State 2022: Most & Least Expensive Revealed

Regardless of whether that's real, be aware that your credit score can be an element in figuring insurance coverage premiums, and do your utmost to keep it high.

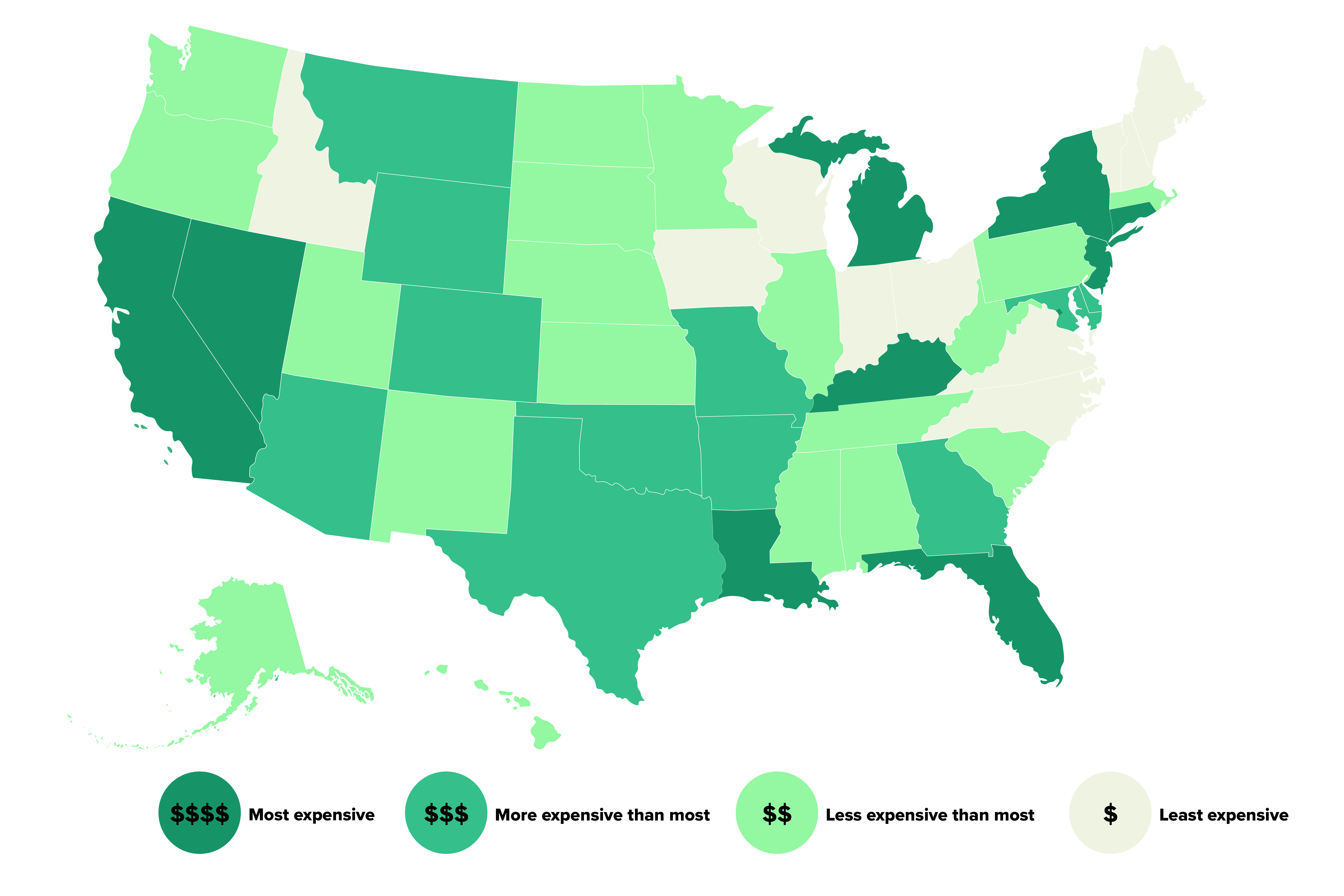

You can check credit reports for free at Annual, Credit, Report. com 9. Consider Location When Estimating Automobile Insurance Coverage Rates It's not likely that you will relocate to a various state simply since it has lower vehicle insurance coverage rates. When planning a relocation, the prospective modification in your vehicle insurance rate is something you will want to factor into your budget plan.

If the worth of the vehicle is just $1,000 and the collision coverage costs $500 per year, it might not make sense to buy it. GEICO, for example, uses a "potential cost savings" of 25% if you have an anti-theft system in your vehicle (money).

Automobile alarms and Lo, Jacks are 2 types of gadgets you might wish to ask about. If your primary inspiration for installing an anti-theft device is to lower your insurance premium, think about whether the expense of adding the device will result in a substantial adequate cost savings to be worth the problem and expense. credit.

There are lots of things you can do to lower the sting. These 15 ideas need to get you driving in the right instructions.

It appears insane to buy anything without knowing what you're going to pay for it, but that's what a great deal of us do when it concerns automobile insurance coverage. Lots of individuals purchase a cars and truck initially and just then begin thinking about car insurance and how much they'll pay.

You can discover more information about your state here at Minimum Requirements by States. "State minimum" and "Requirement Liability" policies are usually minimum or low-limit policies, providing bare-bones coverage. While these policies have lower rates, we advise greater limits to ensure adequate coverage should an accident or vehicle damage take place. affordable car insurance.

Fascination About Uaic - United Auto - High Quality And Low Cost Insurance

This will make you knowledgeable about what your insurance coverage premium may be and enable you to spending plan for it appropriately-- or try to find a company that offers a much better rate provided your situation. How to begin: Decide just how much car insurance protection you require, The three primary types of car insurance coverage you ought to understand are: Liability automobile insurance coverage, Covers others' home damage and medical expenditures. vans.

If you own a home or have a lot of savings 100/300/100 is suggested. That suggests you're covered for $100,000 per person, up to $300,000 an accident for medical costs for those injured in an accident you trigger, and $100,000 for home damage that you trigger. If you want the most inexpensive automobile insurance coverage possible when contrast shopping, search for liability coverage only, and in the quantity your state requires for you to legally drive.

Lots of states' minimum liability requirements are so low that if you were in an accident, and it was figured out or at least thought to be your fault, you could be susceptible to pricey suits, which means you might end up losing your house or savings. We're thinking worst-case circumstance and a really bad claim, but, still, it's something to believe about.

Crash coverage, Covers damage to your automobile, regardless of fault - low-cost auto insurance. If you are in a wreck you won't have to buy a new vehicle with definitely no funds. This pays out as much as the actual money worth of your vehicle if it is found to be a total loss after a vehicle mishap.

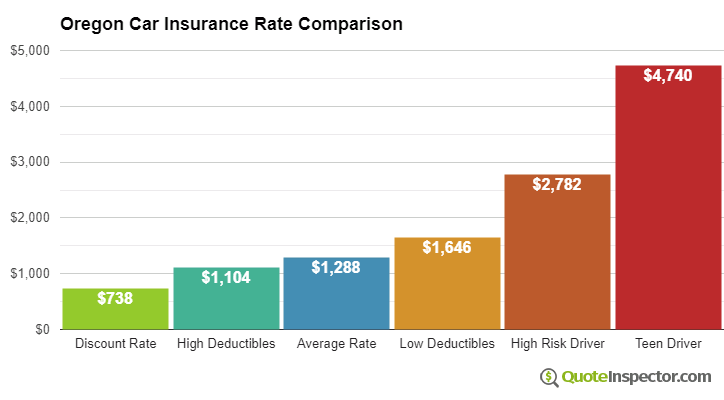

You may not require comprehensive and collision protection if your automobile is more than 10 years-old and not worth much. One of the finest methods to save on car insurance costs is to raise your deductible for crash and detailed insurance.

Expert Recommendations, Loretta Worters, Vice president, Insurance Information Institute, Worters says that beyond simply liability or detailed car insurance, motorists need to think about getting an umbrella policy, which is essentially a fancy term for additional insurance, covering, generally, whatever under the sun."Umbrella insurance can offer protection for injuries, home damage, particular suits, and individual liability scenarios.

How to get accurate estimates? Demand rates from a minimum of three different insurance providers. Be sure to compare the very same cars and truck insurance coverage by utilizing the exact same liability limits, similar deductibles and optional protections. Expert's Idea, When making these contrasts, Yoswick recommends that you keep an open mind and "don't limit your search just to the biggest insurance companies with the best-known trademark name.

Not known Details About Average Cost Of Car Insurance - Nextadvisor With Time

Nevertheless, the quantity state-mandated liability insurance coverage pays for mishaps might not suffice to cover the expenses, leaving you to pay the difference - credit score. Professional Guidance, Mark Friedlander, Director of business communications for the Insurance Information Institute"Possibilities are that you will need more liability insurance coverage than the state needs since mishaps cost more than the minimum limits," observes Mark Friedlander.

For those reasons, you may wish to increase your security to greater physical injury liability limits and higher home damage liability limits: $100,000 per individual, as much as $300,000 an accident for medical costs for those injured in an accident you trigger, and $100,000 for property damage that you trigger. For cost-conscious customers with older cars, it may not be worth the money to insure against damage to your automobile.

"How do I lower car insurance rates? Consider following these tips to lower the cost of cars and truck insurance coverage without compromising protection.

You can call business directly, access details online or work with an insurance coverage agent who can acquire the quotes for you and assist you compare."Maintain a tidy driving record and check your driving record for precision, fix any mistakes. Examine security ratings and buy a car that's considered safe by insurance companies. insured car.

Has appeared often on Excellent Morning America looks, Shopping for automobile insurance coverage is like shopping for anything else."As soon as you settle on a car insurance coverage service provider, this is not your company for life.

Case in point, my partner and I were with the exact same supplier for many years. We assumed that we were getting the very best rate, like we were when we initially signed up, however as soon as we looked around, we understood we could do a lot better.

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO