Not known Details About Sr22 Insurance Cost For You Quotes, Really Cheap Here ...

You need to go to the DMV with the kind in order to have your license reinstated. You are required to keep the SR22 insurance policy for a marked amount of time. Usually this time is between one and also three years yet it is important that you preserve it as long as you require to stay clear of further fees (sr-22 insurance).

Currently, considering that your insurance policy business is the one in charge of submitting the actual data, they tackle this fee when the filing is done, after that they will certainly bill you separately or add the cost to your following insurance coverage bill. In some cases you may be needed to have SR-22 insurance policy for multiple years, in which situation you just pay a charge once for it to be filed the very first time. insurance.

Be encouraged that if there is a lapsemeaning, you did not ask for the revival to be refined on timethen you will certainly have to pay again since you will certainly require brand-new proof of coverage. Normally speaking, you will require to have this certificate of protection for 3 years. However, the actual size of time is contingent upon: where you live as well as what your state regulations are, andwhy the courts required this coverage of you.

https://www.forbes.com/advisor/wp-content/uploads/2020/11/driver-view-e1604646780297.jpg" />

If there was a less dangerous factor, it could be just 2 years. The insurance coverage stays legitimate for as long as you keep your insurance coverage policy. If, for any kind of factor, you cancel this policy or there was a gap in between revivals, your auto insurance will alert your state authorities. insurance coverage.

So, for example, if you are asked to have SR-22 for 3 years, yet then you cancel your insurance coverage after 2 years, the state will likely suspend your license if it had been formerly suspended. They will certainly after that push a figurative pause on that three year mark as well as when you choose to get a brand-new insurance coverage policy in the future, they will certainly begin it up once more.

The size of time you are required by your state to carry the insurance can be prolonged if, during that time, you enter an auto mishap or a website traffic violation. The courts can expand the time you need this insurance, which can raise the cost of your insurance coverage. The factor the cost increases is since additional infractions informs your insurance that you are a risky driver.

Some Known Factual Statements About Cheapest Florida Sr22 Insurance - As Low As $8 / Month!

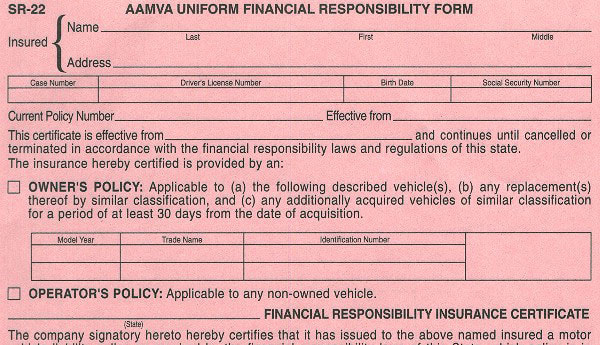

If you pick an AAMVA filing online after that this will certainly be automatically done at the end of your called for time. Any kind of insurance coverage provider in any kind of state can provide this insurance coverage, but not all of them do.

Even if they maintain you on as an insurance policy holder, they can increase the cost dramatically (insurance group). Insurance carriers determine the quantity of money you spend for your protection based on how risk-free a motorist you are, which is why lots of people can get discounts on cars and truck insurance by taking safe driving training courses or going multiple years without offenses or having an electronic unit track how securely they drive.

Bigger business include,,, and. If they will not cover you, there are alternative insurance coverage companies such as,,, and. These are the top ten insurance coverage suppliers for. In order to obtain your insurance coverage approximately day, you will certainly need to obtain a quote for SR-22 insurance policy.

You can obtain a free quote just filling up the form on the top of this web page, and also in a couple of minutes you'll compare numerous budget friendly SR-22 insurance policy quotes (sr-22 insurance). Relying on your state, and the reason for your offense, you may need to submit extra alternate forms. SR-21 Insurance policy, This is a comparable kind however it shows that you have proof of auto insurance coverage.

SR-50 Insurance policy, If you live in the state of Indiana this could be the alternate insurance coverage you are needed to bring. This set is comparable as well as is suggested to assist you obtain your qualified reinstated after it has been put on hold due to your offense. (Mon-Fri, 8am 5pm PST) for a of an economical SR22 insurance coverage, or complete this kind:.

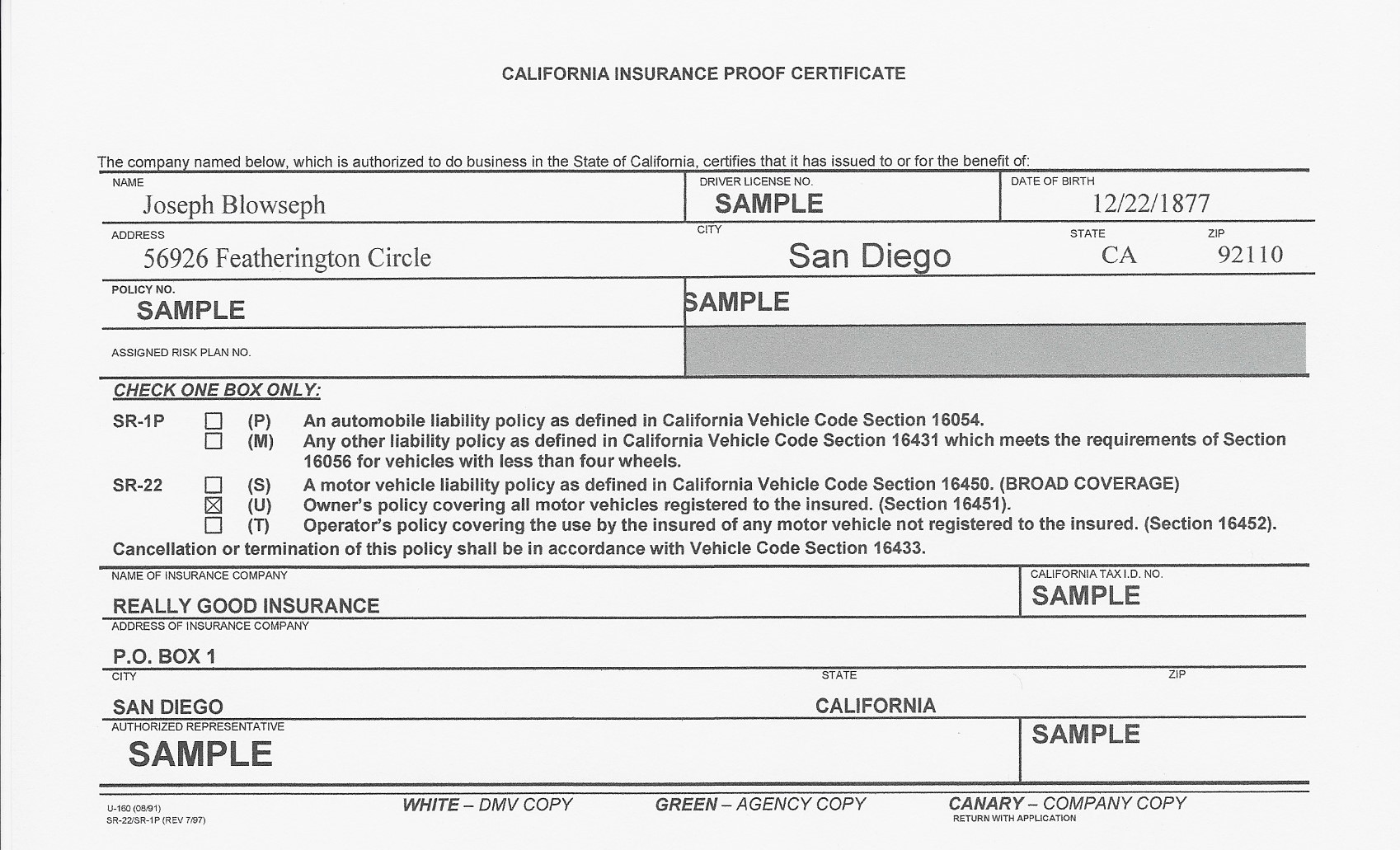

The releasing company additionally must have a power of lawyer on documents in Illinois. The SR-22 should be submitted on a Financial Duty Certificate from the office of the insurance provider. The SR-22 certification is released in among the list below forms: Driver's Certification covers the driver in the operation of any non-owned car.

Illinois Sr-22 Insurance Things To Know Before You Get This

The kind of automobile must be noted on the SR-22 or might be issued for all owned lorries (insure). Operators-Owners Certification covers all automobiles had or non-owned by the chauffeur. When payment is made to an insurance firm, the representative will certainly send a request for an SR-22 certificate to the headquarters.

The individual will certainly obtain a copy of the SR-22 from the insurer as well as a letter from the Assistant of State's office. The insurance policy needs to be preserved for three years. If the SR-22 runs out or is terminated, the insurer is called for by law to alert the Security and also Monetary Responsibility Section by a SR-26 Cancellation Certification.

Out-of-state locals may request their evidence of economic duty for Illinois be forgoed by completing an Sworn statement. The sworn statement uses just to Illinois' insurance policy requirements. In case you relocate back to Illinois within three years from acceptance of the insurance policy waiver, your SR-22 demand for Illinois would certainly be restored.

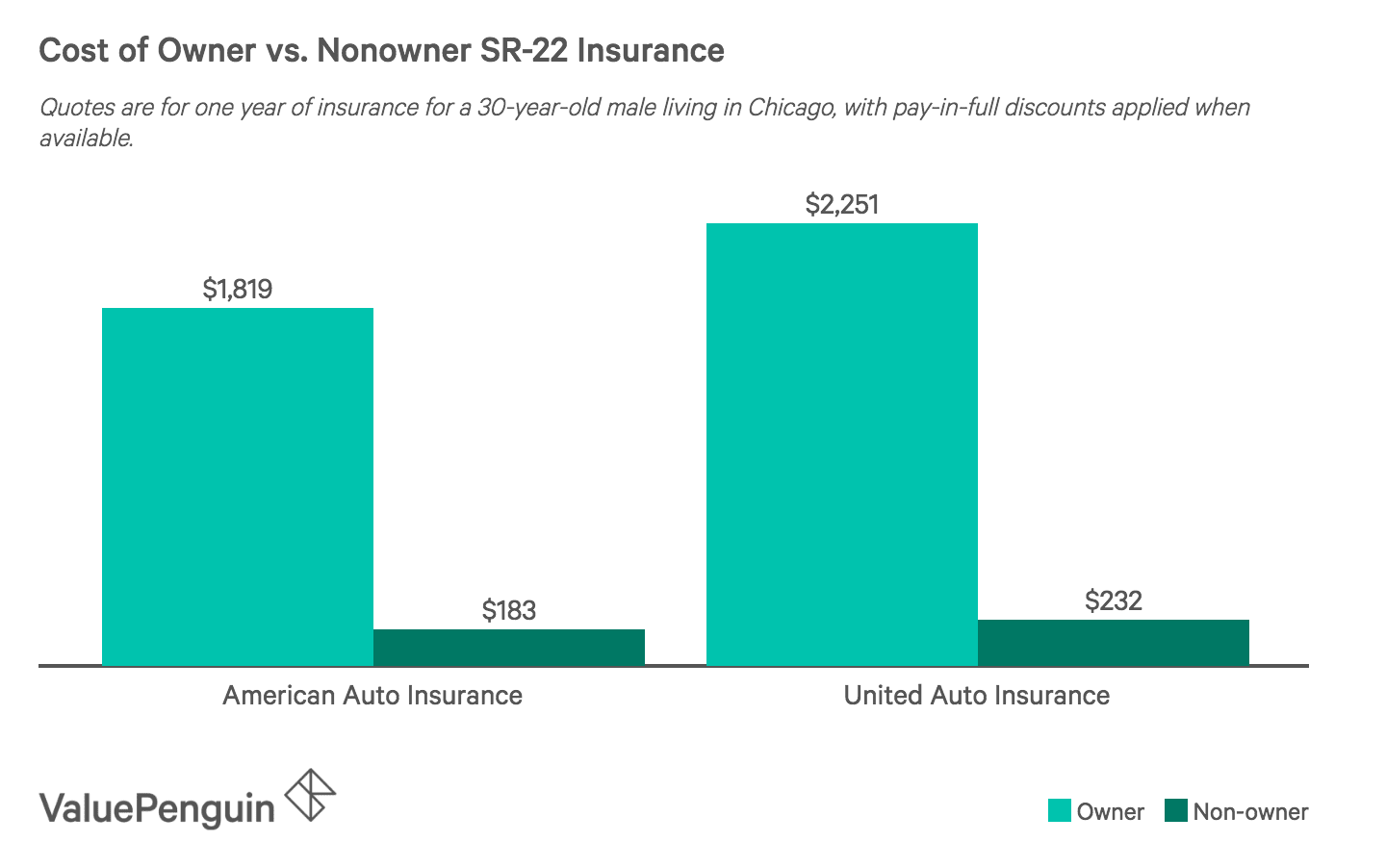

Non-owner auto insurance coverage is insurance coverage for people who don't possess a car yet periodically drive a person else's lorry (coverage). You might take advantage of this type of insurance if you typically lease an auto, obtain a close friend's car, or use car-sharing services. Find out just how non-owner vehicle insurance functions, what it covers, what it does not cover, and also why you might need it.

This type of insurance is best for those that on a regular basis lease or borrow automobiles. Non-owner insurance policy protection begins after the owner's insurance policy protection has been exhausted. The cost savings may not accumulate if you're driving a borrowed or leased car just a couple of times monthly - credit score. Meaning as well as Example of Non-Owner Vehicle Insurance Non-owner automobile insurance is a type of personal automobile insurance policy that covers vehicle drivers that don't own the vehicle they're driving.

SR22 insurance coverage won't instantly drop when you no much longer require it. Contact your state department of electric motor cars to establish just how long you'll require to lug SR22 insurance coverage.

Some Ideas on Sr-22 Insurance - Safeauto You Should Know

You may be needed to have non-owner vehicle insurance policy in some certain conditions, such as if you have a previous background of DUIs. What Does Non-Owner Auto Insurance Coverage Cover? Non-owner cars and truck insurance coverage is a sort of vehicle responsibility insurance that covers physical injury if you're located to be to blame for a mishap.

Do I Need Non-Owner Vehicle Insurance? Non-owner insurance isn't a typical plan.

You Often Rent Cars or Usage Car-Sharing Services Car rental firms as well as car-sharing solutions such as Zipcar must use the state's minimum quantity of liability protection. sr22 insurance. This is needed for their vehicles to be able to operate legally when traveling. But that might not be adequate to cover significant collisions. sr22 insurance.

Non-owner insurance policy can be an affordable option. You still may want to take out physical damage insurance coverage if you obtain a non-owner policy because you usually rent out cars.

You're Between Cars and trucks You may believe that you do not need insurance coverage if you've marketed a car and also you're waiting to get one more, yet service providers like to see that you have not had any type of voids in protection - auto insurance. "Some people do opt to buy the non-owner policy to maintain continuous coverage and also have the very best rates offered when acquiring a new cars and truck," Ahart claimed.

Ask what the non-owner policy covers and about any kind of coverage limits. Not all insurance firms using non-owner automobile insurance policy sell it in every state.

Indicators on Sr-22 Insurance- What Is It And How Does It Work? - Geico You Should Know

"Those that have speeding tickets and other violations or mishaps, or that do not have a document at all, might encounter much steeper prices," Ahart claimed (ignition interlock). Regularly Asked Inquiries (FAQs) Just how much is non-owner car insurance? Where you live, your driving background, your age, as well as your coverage limitations will all influence your non-owner automobile

Welkom bij

Beter HBO

© 2025 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO