How We Calculate Auto And Car Insurance Premiums - Usaa Fundamentals Explained

State hello there to Jerry, your new insurance policy representative. We'll call your insurer, review your current plan, then locate the protection that fits your needs and also saves you cash - cheap car insurance.

low cost auto cheapest vehicle insurance insurance affordable

low cost auto cheapest vehicle insurance insurance affordable

Having Learn here the right information in hand can make it simpler to obtain a precise automobile insurance policy quote (auto). You'll intend to have: Your vehicle driver's certificate number Your automobile recognition number (VIN) The physical address where your vehicle will be saved You might likewise want to do a little study on the types of coverages offered to you.

If you're driving, you likewise need to have automobile insurance coverage. Nobody assumes concerning going shopping for auto insurance coverage.

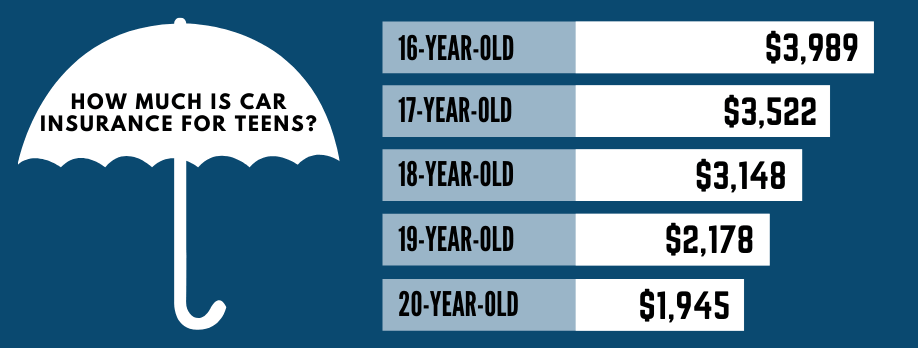

The basic reality is, vehicle insurance policy for university trainees can make up a substantial component of your restricted budget. As well as automobile insurance coverage rates change all the time. Plus, the average expense of car insurance for a 20 year old is $3,816 per year, or $318 per month!

Our Choose For The Cheapest Auto Insurance For University Student, It is necessary to remember that the average yearly cost of automobile insurance coverage in the USA is about $900 each year. That's $75 monthly (car insurance). That's the average for every person. The average expense for university student is about $3,816 annually, or $318 per month.

An Unbiased View of How Pay-per-mile Auto Insurance Works – Forbes Advisor

This compensation might affect exactly how and also where products show up on this site (consisting of, for instance, the order in which they show up). The College Investor does not consist of all insurance business or all insurance provides readily available in the industry - vehicle insurance.

When you integrate cars and truck insurance coverage with renters insurance policy, you obtain a multi-policy price cut, which conserves you a great deal of cash. Greatest Variables To Take Into Consideration When Buying For Automobile Insurance Policy, Buying for auto insurance coverage is difficult because there are so many variables included in what cost you pay. Exactly How College Students Can Obtain

A Discount On Discount Rate InsuranceVehicle One of the hardest parts about components regarding contrasting options insurance policy all the discounts that are available to drivers.

About Safeco Insurance - Quote Car Insurance, Home Insurance ...

Unlike financial institutions or credit cards, altering your vehicle insurance policy is very easy.

You may wish to take into consideration including optional insurance coverage to make sure that you're fully covered. Request a secure driver discount if you have a clean driving document - money. Bundle auto and home owners insurance policy. You could conserve as much as 5% on your cars and truck coverage and 20% on your house plan with The Hartford.

Frequently Asked Concerns Regarding Cars And Truck Insurance Coverage Cost Just How Much is Car Insurance Coverage for a 25-Year-Old? Depending on your auto insurance provider and also the obligation protection you choose, a 25-year-old may pay essentially than their state's ordinary auto insurance coverage price per month. money. When you transform 25, you ought to contact your auto insurance policy business to see if you can save cash on your automobile insurance rate if you have an excellent driving history.

insurers vehicle cheap auto insurance insurance

insurers vehicle cheap auto insurance insurance

You will certainly require to hold a minimum of the minimum needed insurance coverage in instance of a mishap. You may likewise opt for additional coverage that will increase your rate, however also boost your defense in case of a crash. Just How Much Is Complete Coverage Insurance Policy per Month? Full protection vehicle insurance coverage is not the very same for each and every of the 50 states.

What Cars Have the most affordable Insurance Fees? When it pertains to the average vehicle insurance coverage price monthly for different sorts of automobiles, vans normally have the least expensive insurance policy costs. Sedans usually have the highest possible car insurance expense each month, while sporting activities utility vehicles and also vehicles are valued in between. dui.

Unknown Facts About How Much Is Car Insurance? - Liberty Mutual

At What Age Is Auto Insurance the Cheapest? No issue your age, if you want to reduce your cars and truck insurance prices, you need to discover an auto insurance company that can supply you discount rates and advantages.

The quantity you'll pay for automobile insurance coverage is influenced by a number of extremely different factorsfrom the kind of protection you need to your driving record to where you park your automobile (auto insurance). While not all firms use the very same parameters, right here's a list of what generally determines the bottom line on your auto policy.

money car insurance auto insurance cheapest

money car insurance auto insurance cheapest

If you have actually had mishaps or major traffic infractions, it's likely you'll pay greater than if you have a tidy driving record. You may likewise pay more if you're a new motorist without an insurance coverage performance history. The even more miles you drive, the even more chance for mishaps so you'll pay more if you drive your automobile for job, or use it to commute long distances.

Insurers usually bill much more if teenagers or youngsters listed below age 25 drive your vehicle (low-cost auto insurance). Statistically, ladies have a tendency to enter into less mishaps, have less driver-under-the-influence crashes (DUIs) andmost importantlyhave less severe accidents than men. All various other points being equal, ladies typically pay much less for auto insurance policy than their male counterparts.

Comparable to your credit report, your credit-based insurance rating is an analytical tool that predicts the chance of your submitting a claim and also the likely cost of that case (low cost auto). The limits on your fundamental vehicle insurance policy, the amount of your insurance deductible, and also the types and also amounts of policy choices (such as accident) that are sensible for you to have all impact how much you'll spend for protection.

7 Easy Facts About Humana: Find The Right Health Insurance Plan - Sign Up For ... Shown

Automobile insurance coverage is essential to shield you financially when behind the wheel. Whether you just have basic obligation insurance or you have full vehicle protection, it is very important to make certain that you're getting the most effective offer feasible. Wondering how to reduce vehicle insurance policy!.?.!? Right here are 15 techniques for saving on vehicle insurance costs.

Lower vehicle insurance coverage prices may likewise be offered if you have other insurance plan with the exact same company. Maintaining a safe driving record is crucial to getting reduced car insurance policy rates. Just How Much Does Vehicle Insurance Coverage Price? Vehicle insurance policy expenses are different for each motorist, relying on the state they live in, their option of insurance policy firm as well as the sort of coverage they have.

The numbers are fairly close with each other, suggesting that as you allocate a brand-new automobile purchase you may need to include $100 or so each month for automobile insurance. Note While some points that influence car insurance prices-- such as your driving background-- are within your control others, costs may additionally be impacted by things like state laws as well as state mishap rates. insurers.

As soon as you know just how much is cars and truck insurance policy for you, you can place some or all of these methods t work. 1. Make Use Of Multi-Car Discounts If you get a quote from a vehicle insurance provider to guarantee a solitary lorry, you could end up with a greater quote per automobile than if you inquired regarding guaranteeing a number of motorists or automobiles with that said business.

However, if your youngster's qualities are a B average or over or if they place in the leading 20% of the course, you may have the ability to get a excellent trainee discount on the protection, which normally lasts until your kid transforms 25. These price cuts can range from as low as 1% to as long as 39%, so make certain to show proof to your insurance policy representative that your teenager is a great trainee. laws.

Unknown Facts About The Insurance Field - Volume 45 - Page 30 - Google Books Result

low cost auto business insurance low cost auto car

low cost auto business insurance low cost auto car

Allstate, for instance, offers a 10% vehicle insurance discount and a 25% home owners insurance policy discount rate when you bundle them with each other, so check to see if such discounts are available and suitable. Pay Focus

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO