How Long Does An Accident Stay On Your Insurance? for Dummies

Learn how car insurance functions, including just how rates are established as well as what various protection is available. Search as well as online. Obtain the most affordable price. Acquisition your plan with the new supplier at your lower rate. Terminate or do not renew your old plan, however make sure that you have your new plan before you do this.

3Shop around with several companies, There are no laws on exactly how insurance policy business establish their algorithms to identify your rate. Contrast quotes from even more than one vehicle insurance coverage company if you are thinking about making a button.

What to Do if You Have a Truly Negative Driving Record, If you have a truly negative driving record, either as a result of numerous mishaps or from a higher-risk citation like a DUI, you will certainly encounter greater insurance policy rates and also might need to look around to find a firm that will certainly guarantee you. auto insurance.

Exactly How Much Will My Insurance Policy Go Up After an Accident in Maryland? It is an inquiry we obtain constantly. This depends on several aspects - cheaper auto insurance. These consist of: Driving document Sort of auto insurance coverage Severity of the mishap One more variable is the nature of the mishap. You might be marked as a risky motorist in Maryland if the crash is categorized, relevant, or the result of any of the following: Liable accident Speeding Competing Drunk driving sentence Distracted driving Careless driving Violations of various other Maryland driving laws How your automobile insurance policy rates are influenced after a crash varies from one state to another.

In Maryland, the typical premium increase for car insurance coverage for an at-fault cars and truck mishap is just $1,900. In relation to your own insurance, expect a boost to your vehicle insurance premium to enhance 21.

Just How Much Does Vehicle Insurance Coverage Rise Based on the Infraction? If you are responsible for the accident, more than likely your car insurance coverage will certainly go up. insurance affordable. In Maryland, your vehicle insurance costs will certainly likewise likely increase if you are founded guilty for an on-road offense. The more offenses you obtain connected to the crash, the more your automobile insurance coverage will rise.

The 20-Second Trick For Does Car Insurance Go Down At 25? - Policy Advice

If it is a much more extreme infraction such as Drunk drivings or DUIs expect your vehicle insurance coverage will certainly increase around an extra $490 per year. Why Do Insurance Policy Prices Increase After an Automobile Mishap Due to the fact that several vehicle drivers that are at mistake in an auto mishap generally wind up creating one more mishap, they are seen as higher danger.

An auto insurer combines the expense of an insurance coverage with the included danger of the vehicle driver. Resulting in greater premiums for car insurance coverage for chauffeurs that are considered high-risk. The Length Of Time Will My Cars And Truck Insurance Coverage Rate be Higher After a Mishap How lengthy your Find more info vehicle insurance continues to be high will specify to your insurer, the seriousness of your mishap, and your state.

For instance, if you are discovered to blame in a cars and truck mishap that resulted in problems to your vehicle over $2000, you can expect increases in your automobile insurance policy to last for 3-5 years. That is a very particular instance. The severity of the crash and offenses significantly impacts the length of time your insurance will be higher.

Exactly How Can I Obtain a Cheaper Cars And Truck Insurance After an Auto Mishap? If you cause a mishap there is little you can do to prevent greater car insurance policy rates.

In the short-term to get cheaper vehicle insurance after an auto mishap, you need to look at different service providers. Each provider handles drivers in different ways. You will certainly still be considering an increase to your insurance policy after the crash. Nonetheless, you may be able to discover a service provider that will certainly boost your rate much less than your existing company. vans.

Ask for Mishap Mercy This is something that needs to be done when going shopping for insurance. Before getting in a mishap, look for an insurance provider that has accident mercy.

Things about Do Auto Insurance Premiums Go Up After A Claim? - Iii

car vehicle insurance cheap car car

car vehicle insurance cheap car car

In cases that you seek and also are provided accident forgiveness, your auto insurance policy prices won't go up. 2. Participate In Website traffic School Most insurance companies will decrease rates for drivers that have a background of automobile accidents if they go to traffic college. To satisfy the demand you will need to participate in an accepted protective driving program.

Do Not Submit Claims for Little Things The regularly you make insurance claims, the extra your insurance policy business needs to make payments. Therefore it is vital you only file cases for major damages to residential property or for accidents that call for assistance. If you filed a case lately in an at-fault automobile crash, hold-up filing additional cases for as long as you can.

Your car insurance business reviews their customers' premiums on the threat they posture to the company monetarily. Increase Your Credit score Rating In general, people with credit score scores that are more than 600 experience better superior deals.

Consider Your Deductible There is an inverted relationship in between your insurance coverage deductibles and your insurance premiums. Having a higher deductible will result in a reduced premium.

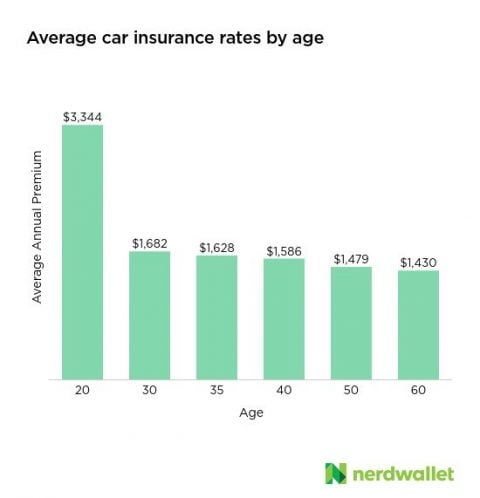

Do Vehicle Insurance Rates Rise In Different Ways Based on Age? In Maryland, car insurance coverage expenses vary based on the motorist's age.

Leaving your insurer with no costs associated to the mishap. Eventually your automobile insurance offers considers just how pricey it is to insure you. If you are at fault for an accident that makes you a greater risk. If you have actually been in serval mishaps that are not at mistake your risk level still boosts.

Learn More About Accident Forgiveness - Geico for Dummies

car cheap auto insurance cars suvs

car cheap auto insurance cars suvs

No-fault vehicle mishaps do show up on your driving record. When you submit an insurance claim and an insurance policy carrier provides you cash that will result in the mishap being area on your driving document.

When a driver that is at at-fault does not have insurance after that your insurance coverage company ends up being responsible to pay for injuries and also problems to your vehicle. Despite the fact that it was not your mistake the crash is much more expensive for your insurance policy firm when the at-fault driver is without insurance. Hence, increasing your auto insurance premiums.

It is necessary for you to stay clear of connecting with them whenever possible to avoid being classified a high-risk chauffeur by them. The Conclusion on Cars And Truck Insurance Policy Rates as well as Accidents It is always a much better scenario when you are not to blame for an accident. perks. Your insurance coverage may still rise, but not virtually as much.

If you have actually remained in a mishap as well as need legal help, please call ENLawyers.

liability insured car automobile trucks

liability insured car automobile trucks

If you're assuming regarding buying that dream auto you've constantly desired, talk to your insurance policy firm about how your rates will be influenced. Bear in mind luxury cars aren't the just one that are at a risky of burglary. Thieves likewise target cars with high-demand parts. 5. Adding a motorist to your policy, All the factors over as they refer to an additional motorist on your plan can inevitably impact your price.

Concerned regarding insuring your teenager chauffeur? If they have a grade point average of a B or far better, they might receive our Excellent Trainee Price Cut. dui. Start your quote today to read more.

How Long Before Insurance Premiums To Go Down After A Dui? Can Be Fun For Everyone

Teenagers are typically a responsibility behind the wheel (automobile). You might pay more for insurance if you are a teen motorist or have a teen running your automobile. Exactly How Can You Decrease Your Car Insurance Policy Rate? Right here are some means you can decrease your cars and truck insurance price: An accident or website traffic violation will trigger your price to go up, so be a good vehicle driver behind the wheel.

The expense of your auto insurance policy premium is based upon a number of variables, from your age, gender, marriage condition, as well as where you prepare to park the automobile, to your driving historyincluding any kind of accidents or traffic infractions on your record. Just due to the fact that you have actually had crashes in the past doesn't mean your insurance policy costs will be influenced permanently.

While the particular computations used to figure out costs rates vary from

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO