An Unbiased View of Sr-22 Insurance Irvine, California

Not all states need an SR-22 or FR-44. If you need one, you'll discover out from your state department of motor automobiles or traffic court. insurance.

When you're notified you need an SR-22, start by contacting your car insurance provider. Some insurance firms don't offer this service, so you might require to look for a business that does (dui). If you do not already have car insurance policy, you'll most likely need to get a policy in order to obtain your driving opportunities recovered.

Insurance quotes will likewise differ depending on what cars and truck insurance coverage company you choose. See what you can save on auto insurance, Quickly contrast individualized rates to see just how much switching car insurance might save you.

Area issues. As an example, take into consideration a motorist with a current DUI, a violation that might lead to an SR-22 demand. Geek, Wallet's 2021 price evaluation located that out of the nation's four largest companies that all submit an SR-22, insurance rates typically were cheapest from Progressive for 40-year-old drivers with a recent DUI.

How Financial Responsibility Insurance Certificates (Sr-22) can Save You Time, Stress, and Money.

In many states, an SR-22 need lasts 3 years. If your plan lapses while you have an SR-22, your insurer is needed to inform the state as well as your certificate will be put on hold. When your requirement finishes, the SR-22 does not instantly diminish your insurance coverage plan. Make certain to let your insurance provider understand you no longer need it.

motor vehicle safety bureau of motor vehicles ignition interlock vehicle insurance insurance

motor vehicle safety bureau of motor vehicles ignition interlock vehicle insurance insurance

Fees usually remain high for 3 to five years after you have actually caused a mishap or had a moving infraction. department of motor vehicles. If you shop about following the 3- as well as five-year marks, you may locate lower costs.

If you have an SR-22 declaring in The golden state and desire the most affordable rates, it's ideal to contrast a minimum of 3 various auto insurance coverage firms to ensure you obtain the most effective possible offer. SR-22 insurance features a filling price, typically an one-time charge of around $25. You'll no longer be qualified for any kind of excellent chauffeur discount rates, making SR-22 insurance even extra costly (motor vehicle safety).

California motorists seeking insurance after a ticket or accident should go shopping around to find lower prices but will not see the exact same high costs as those who need to acquire an SR-22. Exactly how long you need SR-22 insurance in California depends on your sentence, yet it is three years.

The Main Principles Of Sr-22 Insurance: What Is It And How Does It Work? - Kelley ...

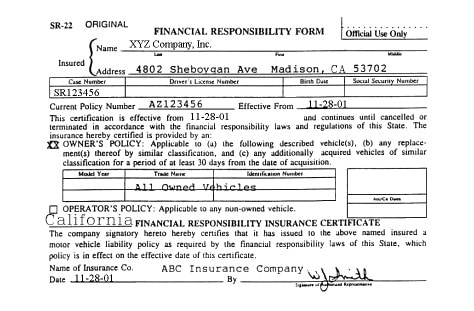

Just how Do You Get SR-22 Insurance Policy in The Golden State? Your insurance coverage firm will submit an SR-22 type with the state upon your demand.

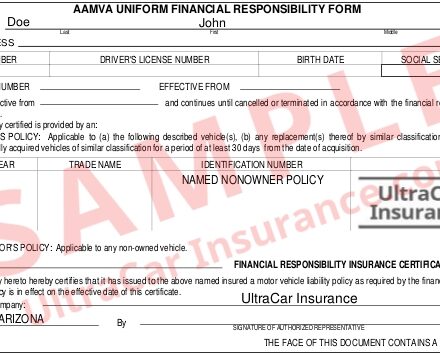

Compare Vehicle Insurance Policy Rates, Ensure you're getting the most effective rate for your automobile insurance policy. Compare quotes from the top insurance provider. Non-Owner SR-22 Insurance Coverage in The Golden State, Drivers in California with significant website traffic violations and a put on hold license may have to file an SR-22 and also acquisition automobile insurance to get their license reinstated.

Typical automobile insurance coverage can be costly for those that do not possess a cars and truck, which is why non-owner vehicle insurance is the very best option for these kinds of vehicle drivers. This permits them to show proof of liability insurance protection to get their license reinstated and also guarantees their defense in the event of one more crash.

FAQs Regarding SR-22 Insurance Coverage in California, Drivers looking for SR-22 insurance in The golden state usually have questions regarding prices, the declaring process as well as who to shop with. An SR-22 type is needed for The golden state motorists that have dedicated a major driving offense, such as a DRUNK DRIVING.

7 Easy Facts About Sr-22 & Insurance: What Is An Sr-22? - Progressive Described

Rather, it's an extra type that insurance providers file with the state on your part. Just how do I obtain an SR-22 certificate in California? Insurance companies are required to submit an SR-22 kind on your behalf electronically if one is called for. In many cases, insurer might pick to no longer cover you if you require an SR-22.

Exactly how a lot does SR-22 insurance policy cost contrasted to a basic plan in The golden state? SR-22 insurance coverage is quite a little bit a lot more pricey than a regular insurance policy in California. Vehicle insurance policy sets you back approximately $1,857 annually for SR-22 insurance coverage as a result of a DUI as well as a standard of just $643 without an SR-22 form.

The very same instance relates to those who do not have an automobile. sr22 coverage. Non-owner automobile insurance is the optimal alternative for those who do not have a car because normal auto insurance can be expensive. That implies that such people will be covered in case of another crash, and also they can likewise reveal evidence of liability insurance policy coverage to obtain their certificate renewed.

The reason why non-owner SR-22 insurance policy is less expensive is that the insurer thinks that you do not drive commonly, as well as the only protection you obtain, in this case, is for liability just. If you rent out or obtain vehicles often, you should take into consideration non-owner car insurance coverage also (sr22 coverage). Prices can differ across insurance providers, the ordinary annual cost for non-owner cars and truck insurance in California stands at $932.

Some Ideas on What Is Sr22 Insurance? – Your Guide To Sr-22 ... - Way You Should Know

Demands for An SR-22 in The golden state First, recognize that an SR-22 impacts your car insurance policy expense and also insurance coverage. After a DUI conviction in California, common motorists pay an average of 166% more than vehicle protection for SR-22 insurance. The minimal period for having an SR-22 in California is 3 years, but one may need it longer than that, depending on their case as well as infraction.

In any one of these situations, an SR-26 type can be submitted by your insurer - liability insurance. When that takes place, your insurance provider ought to show that you no longer have insurance protection with the entity. Starting the SR-22 procedure over again will be necessary if your company submits an SR-26 prior to completing your SR-22 demand.

MIS-Insurance offers affordable SR22 insurance coverage that will certainly save you cash over the life of your plan - sr-22. Budget-friendly SR22 insurance is available and we will certainly can aid you protect the appropriate plan for you.

dui no-fault insurance car insurance insurance companies liability insurance

dui no-fault insurance car insurance insurance companies liability insurance

A drunk driving will immediately increase your rates without considering added rate rises and reject you discount rates also if you were previously getting a great vehicle driver price cut. As an example, Look at more info rather of paying $100 monthly for vehicle insurance policy, a driver with no DUI background will just pay $80 month-to-month, many thanks to the 20% good motorist discount rate they obtain.

The Ultimate Guide To Protect Yourself With Sr22 Liability Insurance From Breathe Easy

What you require to learn about SR-22 Declaring in California When it involves problems pertaining to vehicle insurance coverage, our driving records, as well as legal rights and also advantages, in some cases we are shown things that merely are not real. Let's check out a few of the most usual misconceptions as well as misconceptions concerning the SR-22 California: What is the SR-22 Motorist Declaring? An SR-22 is a certification of insurance policy filed by your insurance provider straight to the Division of Motor Automobiles.

SR-22 Minimum Responsibility Purview The minimum obligation restrictions have to satisfy your state's demands. Your Cost-U-Less customer care agent can tell you what the minimum needs are for your state. How the SR-22 Declaring Process Functions There is not much for you to do in this procedure. All you have to do is request your insurance provider to file an SR-22 for you, after that the insurance provider deals with the remainder.

Avoid Future SR-22 Cancellations and Suspensions Once you have your SR-22 protection, you desire to make certain it does not obtain terminated or put on hold. The earlier you restore it, the much safer you'll be and also the less likely your SR-22 will certainly be terminated.

You have to pay $55,000. 00 in safety and securities with the state treasurer! When Is an SR-22 Called for? Not all states require an SR-22, however the ones that do might need them for any of the adhering to factors: Unhappy Judgments Major Convictions License Suspensions No Insurance Violations No Insurance Policy At The Time Of The Crash The Golden State SR-22 Filing Cost-U-Less can aid you file an SR-22 in California and also we can additionally help you obtain inexpensive SR-22 insurance.

Sr-22 - A-max Auto Insurance - An Overview

Although filing charges are fairly low, drivers who need SR-22 insurance will locate

Welkom bij

Beter HBO

© 2025 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO