All about Does Car Insurance Go Down At 25? - Experian

There are lots of things you can do to minimize the sting. These 15 suggestions need to get you driving in the right direction.

It appears insane to purchase anything without understanding what you're going to pay for it, however that's what a lot of us do when it pertains to cars and truck insurance - low-cost auto insurance. Lots of individuals buy a vehicle initially and just then start believing about automobile insurance coverage and how much they'll pay.

You can discover more information about your state here at Minimum Requirements by States. "State minimum" and "Standard Liability" policies are normally minimum or low-limit policies, offering bare-bones coverage. While these policies have lower rates, we advise higher limitations to guarantee sufficient coverage must an accident or car damage happen.

This will make you familiar with what your insurance coverage policy premium might be and permit you to spending plan for it appropriately-- or try to find a provider that uses a much better rate provided your scenario (cheap car). How to start: Choose just how much cars and truck insurance coverage you require, The 3 primary kinds of cars and truck insurance coverage you must comprehend are: Liability car insurance, Covers others' residential or commercial property damage and medical expenditures.

If you own a house or have a lot of cost savings 100/300/100 is recommended. That means you're covered for $100,000 per person, up to $300,000 a mishap for medical bills for those hurt in an accident you trigger, and $100,000 for home damage that you cause (cheapest car insurance).

Numerous states' minimum liability requirements are so low that if you remained in an accident, and it was identified or a minimum of thought to be your fault, you could be susceptible to costly lawsuits, which implies you might wind up losing your home or cost savings (insurance). We're thinking worst-case scenario and an actually bad claim, but, still, it's something to think of.

Accident coverage, Covers damage to your vehicle, regardless of fault. laws. So, if you are in a wreck you won't need to buy a new car with definitely no funds. This pays approximately the real money value of your vehicle if it is found to be a total loss after an automobile accident.

Top Guidelines Of Florida Blue: Florida Health Insurance Plans

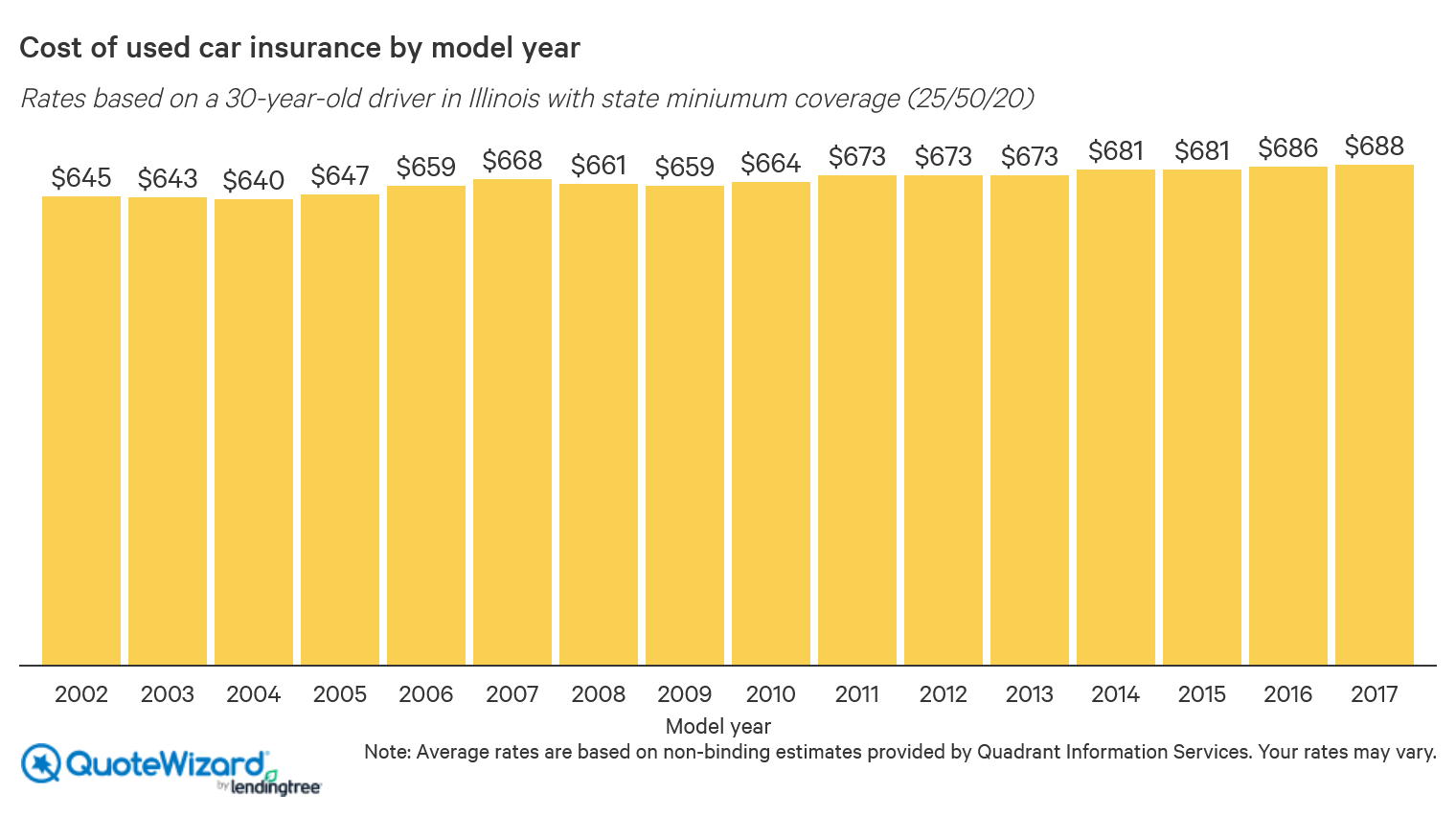

You may not require thorough and crash protection if your car is more than 10 years-old and not worth much (insurance company). One of the best ways to save on auto insurance coverage expenses is to raise your deductible for crash and extensive insurance coverage.

If you have more than one claim, you'll need to pay the deductible each time. We advise you choose an amount that you can pay from cost savings. Your vehicle will not be fixed up until you pay your share. Professional Suggestions, Loretta Worters, Vice president, Insurance Details Institute, Worters says that beyond just liability or thorough cars and truck insurance, drivers should think about getting an umbrella policy, which is basically an elegant term for extra insurance coverage, covering, essentially, whatever under the sun."Umbrella insurance can offer coverage for injuries, residential or commercial property damage, certain lawsuits, and personal liability circumstances.

How to get precise estimates? Demand rates from a minimum of 3 various insurance companies. Make certain to compare the exact same vehicle insurance protection by utilizing the very same liability limitations, similar deductibles and optional coverages. insure. Expert's Pointer, When making these contrasts, Yoswick recommends that you keep an open mind and "don't restrict your search just to the biggest insurers with the best-known trademark name.

The amount state-mandated liability insurance coverage pays out for mishaps may not be adequate to cover the expenses, leaving you to pay the difference. Professional Advice, Mark Friedlander, Director of business communications for the Insurance Information Institute"Opportunities are that you will need more liability insurance coverage than the state needs because accidents cost more than the minimum limits," observes Mark Friedlander (low cost auto).

For those factors, you might desire to increase your defense to higher physical injury liability limits and higher residential or commercial property damage liability limitations: $100,000 per person, as much as $300,000 an accident for medical costs for those injured in an accident you trigger, and $100,000 for residential or commercial property damage that you cause (affordable). For cost-conscious customers with older vehicles, it might not deserve the cash to guarantee against damage to your cars and truck. cheapest car.

If your car deserves less than 10 times the premium that you are spending for these additional coverages, buying these protections may not be cost efficient. If you take this path, be prepared to pay for all associated losses out of pocket."How do I lower automobile insurance rates? Think about following these pointers to lower the cost of cars and truck insurance without compromising coverage.

You can call companies directly, access information online or deal with an insurance coverage representative who can get the quotes for you and assist you compare."Preserve a clean driving record and examine your driving record for accuracy, fix any mistakes (cars). Inspect safety ratings and buy a vehicle that's thought about safe by insurer. vehicle insurance.

The Only Guide to Car Insurance Costs: Comparing Auto Insurance Rates Needed ...

Has appeared frequently on Excellent Morning America looks, Looking for vehicle insurance resembles searching for anything else. You should always compare rates," Bodge says. "There are a lot of companies out there, and while they generally consider factors like your age, driving history, type of vehicle, etc, rates can differ widely from supplier to service provider.""As soon as you settle on a cars and truck insurance coverage provider, this is not your provider for life.

Case in point, my hubby and I were with the same service provider for years. We assumed that we were getting the best rate, like we were when we first registered, however when we went shopping around, we understood we could do a lot better. If your credit score enhances over time, you could qualify for a more beneficial automobile insurance coverage rate" (insurance).

That indicates you have a concept of what you'll pay without having to provide any individual info. cheapest auto insurance. When getting actual quotes from insurance companies, you'll generally have to offer at least the following: Your license number, Car identification number, Your address, or where the cars and truck is kept when not on the roadway, Often asked questions while estimating automobile insurance expenses, You've got more questions? We have the responses.

org, Powered by A Plus Insurance, She recommends customers when looking for insurance coverage estimates to ask a great deal of concerns, and if you're talking with a broker, allow yourself enough time on the phone to get the proper descriptions and details about your policy. When comparing cars and truck insurance coverage rates, it is necessary to look at the price, make certain the protections match with every quote so you are comparing apples to apples, and take a look at the insurance provider's track record," Mckenzie states.

And was the MVR (motor lorry report) run on each quote, What are the factors that impact cars and truck insurance rates? A range of rating factors identify how much you will pay for car insurance coverage - prices.

Type of car, Age & years of driving experience, Geographical location, Marital status, Driving record, Annual mileage, Credit report, Chosen coverage, limits and deductibles, Why some vehicles are cheaper to insure than others? Car insurers track which vehicles have the most wrecks and the worst injury records. low cost. Those elements affect the cost you pay for liability insurance-- which covers the damage you trigger to other and not the damage to your vehicle. affordable car insurance.

Welkom bij

Beter HBO

© 2026 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO