6 Simple Techniques For How To Finance A Home Remodel

Obtaining cash from charge card companies is very various from securing a home mortgage to acquire a house, so it makes sense that any finance charges for the two might be different. When you're making an application for a credit card, the financing charges you might have to pay need to be revealed in a prices and terms sheet. In specific, you need to search for the following common charge card financing charges: Many credit card providers utilize your typical daily balance to compute your interest charges each billing cycle (What does ear stand for in finance). If your card provides a grace duration, you can avoid paying purchase interest as long as you pay off your balance on time and in complete by the due date every month.

Figuring out the financing charges for a larger deal, like a home mortgage, can be more complex. There are more factors included and the deal is generally much larger. Here are some major mortgage charges to look out for. Interest paid, Origination fees, Home mortgage insurance, Other appropriate loan provider charges: You ought to have the ability to find finance charges in the Loan Calculations section on Page 5 of your Closing Disclosure. Wish to minimize interest? Having the ability to determine finance charges is a fantastic ability to have. It permits you to compare financing charges between 2 comparable debt options, so you can figure out which credit alternative is much better for your situation based upon the whole photo not just the rates of interest.

If you'll have to pay $50 in financing charges to pay off a $100 charge card purchase, you're probably much better off waiting if at all possible till you can manage to pay cash. However if you 'd need to pay $1,000 in financing charges over the life of a three-year loan for a $10,000 automobile that you need to commute to a higher-paying job, it could be well worth the expense. In many cases, it might make good sense to choose a loan with higher financing charges due to some other feature of the loan. For example, you might have to pay more in financing charges for a loan with a longer payment duration, however it might come with a lower month-to-month payment that fits your budget plan better.

Financing charges may not be limited to the interest you pay search for other charges that you would not need to pay if you were making the exact same transaction in money rather of with credit. Finance charges are an extra expenditure for purchasing (How to finance a franchise with no money). You're spending for the ability The original source to utilize somebody else's cash. Often this makes sense, but other times it might not be a monetary decision that helps you in the long run. And remember: Though it's not always possible, the surest method to avoid finance charges is to pay in money. Wish to save money on interest? Lance Cothern is an independent author specializing in personal financing.

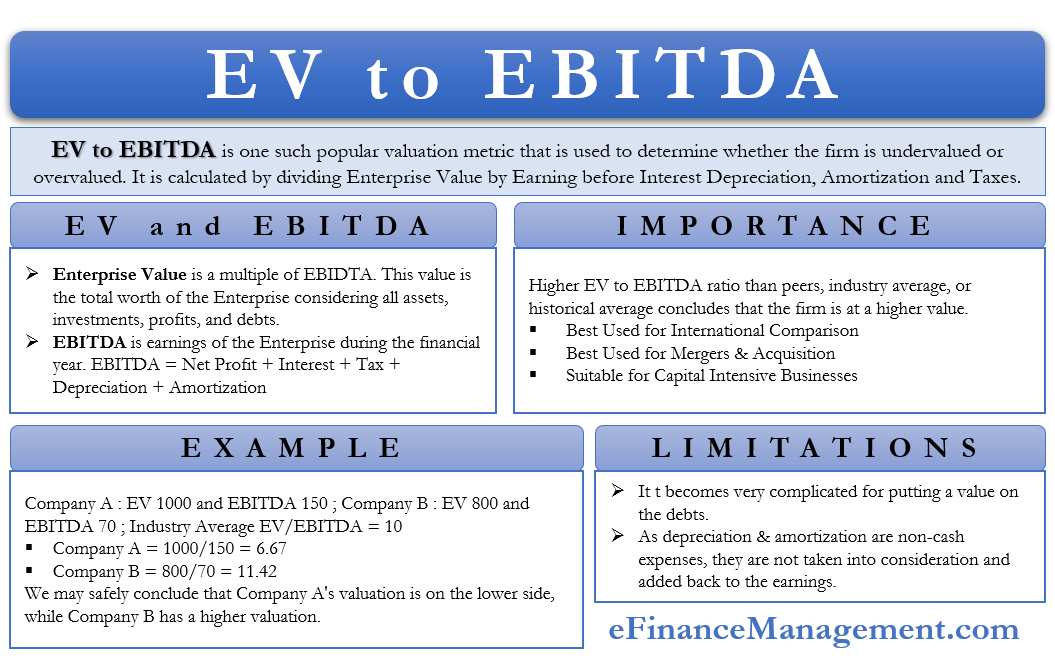

If you have actually been researching various offers for secondhand cars and truck funding, you have actually probably run into some companies billing you a finance charge instead of charging a monthly rates of interest. Both finance charges and rates of interest must be provided to you in an APR, or annual portion rate. This can make the 2 seem the very same, but they are in fact a bit different. Finance charge can likewise have more than one meaning. According to accounting and finance terms, the finance charge is the overall costs that you pay to obtain the cash in question. This implies that the finance charge consists of the interest and other costs that you pay in addition to repaying the loan.

When it comes to personal financing matters, such as for a payday loan or purchasing an utilized automobile on credit, the financing charge describes a set amount of money that you are charged for being given the loan. Some lending institutions will charge you this quantity regardless of whether you settle the loan early. By contrast, when you are charged a rate of interest you will pay less to obtain the cash if you pay it off rapidly. It can be arguable which is more, a straight financing charge or a rates of interest, or the combination of interest and fees.

Put just, a financing charge is the cost of obtaining cash - How to become a finance manager at a car dealership. With a vehicle loan, the finance charge includes the regular payment of interest on the impressive balance, in addition to any application charges, filing costs, etc.

6 Easy Facts About What Was The Reconstruction Finance Corporation Shown

[MUSIC PLAYING] [Words appear: wesley timeshare cancellation reviews Making, Cents, Car Payment] Getting a brand-new car is a huge offer, so ensure you totally understand the monthly payments and other costs that come with it. It will keep you happy, even after the new automobile smell begins to fade. [Words appear: Down Payment] A deposit is wesley financial group llc reviews what you pay in advance in order to protect a loan. The more money put down, the less you have to borrow. The greater your down payment, the lower your regular monthly payments and less you pay in interest. After deducting the down payment from the purchase price, you are entrusted to the quantity you have to obtain-- the principal.

[Words appear: Principal: The quantity of money obtained from a lending institution to make a purchase] [Words appear: Interest] Lenders charge interest on what you borrow. Rates are figured out by aspects such as deposit, length of loan, and credit rating. The higher the interest, the more you pay per month. [Words appear: Loan Term] The length of time you need to pay off your loan will affect your monthly payment and the overall cost of the car. Since you settle short-term loans much faster, you end up paying less interest on the loan. [Words appear: Amount owed in interest plus principal/loan term equal monthly payment] [Words appear: Tags, title, taxes] These are one-time costs you pay for the right to the vehicle.

[Words appear: Expense and factor to consider] So far, we've simply talked about purchase expenses, however there are other factors to consider. [Words appear: Lorry maintenance] Ensure you investigate the typical upkeep costs prior to acquiring, or compare warranties on brand-new automobiles which will cover lots of maintenance problems for a time. [Words appear: Personal home tax] Some local jurisdictions apply an annual individual residential or commercial property tax to vehicles. Know your state's rules and spending plan accordingly. [Words appear: To find out if your state charges individual property tax, contact your regional department of automobile.] [Words appear; Insurance coverage] Car insurance is required in all states, but the quantity of protection you need varies.

[Words appear: Pointer, many insurance providers use a discount if you utilize them for both house and auto coverage.] Ensure you're conscious of the overall expense of your automobile over the life of the loan. Remember, even if the month-to-month payment appears affordable, you might be paying more than you think. Keep this in mind as you buy your next automobile, and you'll be geared up to make the ideal option for you and your budget. [Words appear: Navy Federal Cooperative Credit Union. This video is planned to supply basic info and shouldn't be considered legal, tax, or financial recommendations. It's always a good concept to speak with a tax, financial or other advisor for specific details about your private monetary scenario.

Welkom bij

Beter HBO

© 2026 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO