5 Easy Facts About Renters Insurance: What To Know Before You Rent - The Zebra Described

Your landlord carries insurance on the residential property itself, which will cover physical damages to the structure in case of a covered occasion, as well as might also have a residence warranty on the home to aid cover the price of upkeep and repair. cheap. The landlord's insurance will certainly also cover their liability in case a person is wounded on the residential property.

This protection secures you financially. If an accident takes place in your rented out home, the target of the crash can sue you to spend for their medical expenses and also other monetary damages because you are accountable, or liable, for what occurs in your house - affordable. These cases can place to countless dollars: Without insurance coverage, occupants can be bankrupted by liability insurance claims, so it deserves spending in insurance coverage that covers your obligation by paying for these expenses approximately the policy restriction.

You'll likely still be paying lease, so the expenses of living at a hotel can actually mount up swiftly. Occupants insurance policy will cover the cost of these expenditures (cheapest). Along with paying for a place to live during the repair work after a significant insurance claim, you'll sustain various other costs quicker than you could visualize.

You might need to pay to park your car, or commute farther, or pay to have your youngsters transported to institution. credit. The Loss of Use advantage in your renter's insurance coverage covers these additional prices that build up due to the fact that you can't be in your very own home. Loss of Usage as well as Added Living Costs are often combined under one name or the other, however in the situation of a claim that requires you to vacate, you'll intend to seek these benefits.

Keep in mind, thoughhomeowners insurance coverage covers the structure, the residents, and the property surrounding it. Occupants insurance covers you and also your rented out room. With an average expense of $168 per year, occupants insurance is a fantastic investment to shield your possessions, your responsibility, and your savings: If every little thing you have is wiped out by a fire, the amount you'll lose in changing every little thing is much more than the premium you'll pay to safeguard yourself. discount.

Image: depositphotos. com, Not all rental insurance firms are the very same; treatments and accessibility can vary. Along with accumulating all the details you'll require on costs and also fundamental coverage concerns, there are a couple of details things you'll intend to ask your agent prior to authorizing your plan. Some occupants insurer call for roomies to acquire separate plans, however others allow occupants to share a policy as long as they settle on all the terms (options).

9 Simple Techniques For Renters Insurance - Mass.gov

This is vital: Money value coverage pays exactly how much your building deserves, so the original price minus an amount based on the length of time you've owned it as well as the condition it was in. Substitute expense pays out what it will cost to buy a brand-new thing to change the loss - landlord.

insurance low cost rental price low cost

insurance low cost rental price low cost

For tenants that move annually, this is an essential question. The solution is normally indeed, yet you'll desire the information on how to move the policy and also what costs may be associated. Lots of people do not even realize that occupants insurance policy exists until they're informed that they need to get a policy, however the product supplies real get more info protection for renters who have existed without the convenient umbrella of insurance for years - rental.

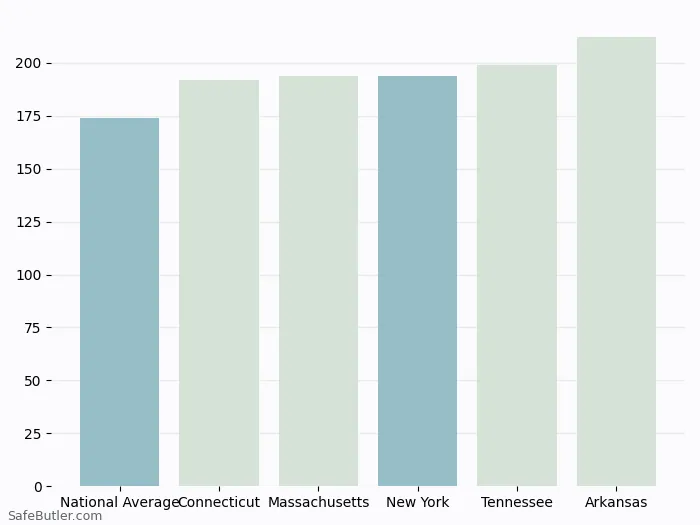

These are some of the questions we hear most regularly, in addition to their answers, and they need to obtain you began thinking in the right instructions. Image: depositphotos. com, The current nationwide standard for renters insurance policy is $168 each year, plus the price of fulfilling the insurance deductible previous to the payment of a claim.

affordable affordable coverage renters affordable coverage insurance

affordable affordable coverage renters affordable coverage insurance

Yes! Insurance coverage firms love safety systems because they substantially lower the likelihood of burglary and can function as an early-warning system in situation of fire, decreasing the overall price of a loss. You'll wish to consult your renters insurer prior to selecting a protection system to see what specifications the system need to fulfill to receive a price cut.

liability cheapest affordable renters insurance cheapest renters insurance property insurance

liability cheapest affordable renters insurance cheapest renters insurance property insurance

It doesand the building does not also have to remain in your leased home when it's swiped to certify. damages. If products are swiped from your home or while you're at job, school, or out on the community, they will likely be covered. In enhancement, things maintained in a rented storage space device may be covered, however you'll wish to talk to your insurance service provider to see if that uses to you.

Often the discussion of the case needs to be gone through lawyers for both insurer as well as the renter, and afterwards based on the values of the case, it could go to a court or a trial to be cleared up, which can take an uncertain amount of time. Yes, and you might also get a discount rate for doing so (cheap renters insurance).

See This Report about 6 Best Renters Insurance Companies In New York Of 2022

To encourage even more individuals to do so, insurance coverage companies usually offer rewards to pay in advance (insurance). Yes, as long as the products belong to you as well as are harmed or shed due to a covered occasion. Whether your things remain in your auto, a locker, a workdesk cabinet, or the backyard, they'll be covered by your plan as long as the damages took place during an event that is covered by your plan.

coverage bundle credit damages renter's insurance

coverage bundle credit damages renter's insurance

After you've resolved right into a new apartment or condo, renters insurance policy may not be first on the checklist of your monetary concerns. While tenants insurance could not appear immediate, you shouldn't go without it because it can protect your residential or commercial property and conserve you cash in instance the unexpected takes place. Money, Geek analyzed prices throughout all 50 states and numerous cities to establish the typical expense for consumers based upon varying protection levels - insurance.

Renters insurance policy is a low-cost way to cover your personal effects, with plans offered for just a couple of bucks a month. Ordinary Regular Monthly Occupants Insurance Policy Cost This Year, Price is an important aspect for tenants insurance coverage, as well as an appropriate plan may be more cost effective than you think. The typical price of tenants insurance coverage this year has to do with $13 each month, or $159 per year, for $20,000 of personal residential property protection, $100,000 of liability insurance coverage and also a $500 deductible.

Common Price of Renters Insurance Coverage by Insurance Coverage Quantity, Among the primary variables in the cost of tenants insurance coverage is your individual residential property value, which identifies what protection quantity you'll require. Occupants insurance policy raises in rate as your coverage quantity boosts, so you'll likely wind up paying more if you have several beneficial properties.

For $20,000 well worth of individual building insurance coverage, both Allstate as well as State Ranch have extremely affordable annual prices, with a national standard of $10 each month for Allstate and also $11 for State Ranch. Scroll for extra Allstate provides inexpensive insurance coverage for tenants looking to secure their personal effects. For just a few dollars a month, you can relax assured that your residential property is shielded if something negative takes place (cheapest).

Like Allstate, State Ranch likewise supplies renters insurance coverage at an inexpensive rate - cheap. Allstate plans cover personal effects like computer systems, Televisions, electronic devices, furnishings, clothes and even more due to burglary, fire, smoke damages and unexpected and accidental water damages. You can minimize insurance policy by packing occupants and also car coverage with State Ranch.

The Best Guide To How Much Does Renters Insurance Cost? - Trusted Choice

rental renter affordable renters insurance cheap renters insurance rental insurance

rental renter affordable renters insurance cheap renters insurance rental insurance

While it might lead to a somewhat higher monthly costs, you should be truthful with yourself regarding the value of your ownerships and what they would cost to replace. vehicle insurance. When selecting

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO