10 Easy Facts About What Car Insurance Deductible To Choose - Direct Auto Shown

Your automobile insurance deductible is your obligation and also must be paid prior to your insurance policy service provider covers the remainder. As a consumer, you can typically pick a higher insurance deductible as well as score a lower vehicle insurance policy costs.

If any type of damage or fixings are much less than the price of your deductible, after that it's not worth submitting a claim. On the various other hand, if you select a lower cars and truck insurance deductible in between $100 and $500, the possibility of you submitting a claim increases. That implies you'll likely pay a higher monthly premium as well as be taken into consideration more of a danger to your insurance policy carrier.

car insurance low-cost auto insurance insurance company affordable

car insurance low-cost auto insurance insurance company affordable

When do you pay the deductible for car insurance policy? You do not have to pay your auto insurance deductible when choosing a car insurance plan. You have to pay your automobile insurance deductible when you make an insurance claim.

Keep in mind, ultimately, paying your deductible is up to you. If you would certainly rather not send a claim, you don't have to pay your deductible, however you will certainly be in charge of the entire price of your repair service. What are the various sorts of automobile insurance coverage deductibles? When you choose a car insurance plan, you enroll in a certain sort of insurance coverage that can assist in certain situations.

10 Easy Facts About How Can You Find Your Car Insurance Deductible? - Jerry Explained

Comprehensive insurance coverage Comprehensive coverage covers the expense of fixing or replacing your lorry in scenarios beyond a basic accident. So if your auto gets damaged in a fanatic hailstorm or struck by a deer, or winds up being swiped, extensive coverage will certainly concern the rescue. This type of insurance coverage is typically sold in tandem with collision insurance coverage.

This type of insurance coverage helps cover the expense of repair work or any required replacements if there's an occurrence. In the event you get into an accident with an uninsured motorist or one with restricted insurance coverage, this type of insurance can aid cover costs.

This may not be offered in every state or by every insurance coverage carrier. Individual injury security (PIP) Medical prices are a worry for many individuals. Injury defense insurance can assist cover medical expenses after an accident despite who is located at-fault. Some states like New Jacket require this kind of insurance coverage as it's thought about a "no fault" state.

If you choose a reduced vehicle insurance coverage deductible amount, it's most likely your costs will be higher. While you're paying more currently, if something happens down the line and also you enter into a crash, you'll pay less out-of-pocket then. Your insurance deductible amount should be something you really feel comfy paying or have easy accessibility to in an emergency fund, or as a last hope, a credit line. insurance affordable.

The smart Trick of How Do Car Insurance Deductibles Work? - U.s. News That Nobody is Talking About

On the various other hand, thorough and also accident insurance can cover mishaps, burglary, as well as climate occasions that can come out of nowhere. You can pick the deductible quantity for each type of insurance coverage, so if you believe you are a risk-free driver, it may make sense to have a greater accident insurance deductible (where you can often stop a collision) versus comprehensive (where the occasions are normally out of our control).

insurance insurance dui business insurance

insurance insurance dui business insurance

That implies considering your threat degrees, requirements, funds, and also more. You likewise desire to make sure you have the ideal protection to safeguard yourself in numerous scenarios. If you're still paying for miles you aren't driving, it's time to rethink your car insurance coverage.

A car insurance policy deductible is the amount an insurance holder is accountable for paying when making a claim with their car insurance company after a covered incident. This has to happen prior to insurance coverage pays the expenses of problems. For instance, if a vehicle sustains $5,000 worth of damages in a protected mishap and also the vehicle driver has a $1,000 insurance deductible, they would pay $1,000 of the repair work expenses and also the insurance company would certainly pay $4,000. cheaper.

insurance affordable insurance affordable insurance company insurance companies

insurance affordable insurance affordable insurance company insurance companies

The driver would simply pay their deductible. When you do not have to pay an automobile insurance coverage deductible, There are specific circumstances when individuals don't need to pay an automobile insurance deductible. If one more driver creates a crash and their insurance policy pays In many states, a motorist who is in charge of creating a collision is obliged to pay for all problems associated with the crash.

What Does Who Pays The Deductible In A Michigan Car Accident? here Do?

If somebody's own car is also harmed in the very same incident as well as they want to make a claim for repair work under their collision insurance coverage, their deductible will use. If the certain kind of damage doesn't need paying a deductible In some instances, certain losses are covered without an insurance deductible.

If somebody opted for no insurance deductible when getting protection Insurance firms might allow people to decide for coverage with a $0 insurance deductible. If a person has no deductible, they won't owe anything out of pocket when a covered occurrence occurs.

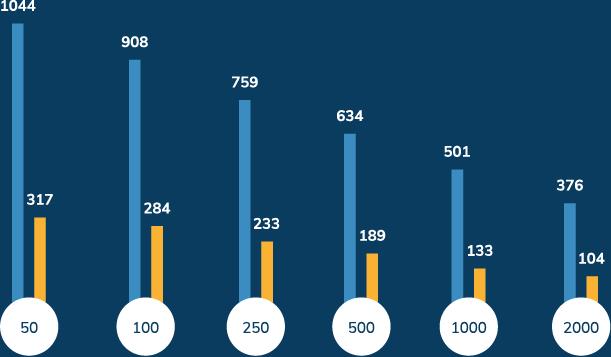

Normally, chauffeurs require to pick an insurance deductible for thorough coverage, accident insurance coverage, and also accident protection. What's the typical automobile insurance policy deductible? The typical auto insurance policy deductible is $500. People can choose a deductible amount anywhere from $0 to $2,000 with most insurance providers. Exactly how much of a deductible should I pick for my automobile insurance policy? The objective when obtaining an vehicle insurance policy quote is to get high quality as well as cost effective insurance - perks.

Below are some crucial factors to consider. Risk resistance, When picking a plan with a greater insurance deductible, people take a bigger risk. They're betting that they won't require to make a claim and also pay out-of-pocket costs. Those who aren't comfy taking that chance may wish to pay higher costs to pass even more of the danger of monetary loss on to their insurance policy carrier. low cost auto.

Top Guidelines Of How Can You Find Your Car Insurance Deductible? - Jerry

Those who have a tendency to have little cash money conserved for unexpected expenditures might wish to pick a lower deductible. prices. Individuals with a hefty reserve can probably afford to take a chance of sustaining higher out-of-pocket expenses if they make an insurance case. The likelihood of a case, The most likely it is someone will certainly make a case, the lower they ought to set their insurance deductible.

But if the possibilities of a protected incident are unlikely, a vehicle driver may be better off keeping their premiums reduced. Some individuals can save around $220 each year on extensive and also accident coverage by switching over from a plan with a $50 insurance deductible to one with a $250 insurance deductible. By placing the premium cost savings into a bank account, a person could have sufficient cash in around a year to cover the added insurance deductible amount (vehicle insurance).

As long as a vehicle driver doesn't obtain right into a crash in less than a year, they would certainly be better off. The value of the automobile, If an automobile isn't worth a lot, it might not pay to have insurance coverage with a high deductible. State a vehicle driver goes with crash coverage with a $1,000 deductible and also their car is only worth $1,000.

In this situation, the motorist would be much better off giving up accident protection totally. Just how to stay clear of paying a car insurance deductible, The most effective method to stay clear of paying a vehicle insurance deductible is to prevent mishaps, theft, or damage. Practice protective driving, comply with the guidelines of the roadway, follow the rate limitation, and avoid driving in bad weather condition.

Not known Facts About How Does Car Insurance Work? - Investopedia

Individuals can additionally choose a policy with no deductible, albeit at a higher expense. Or they can authorize up for a disappearing or disappearing insurance deductible with

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO